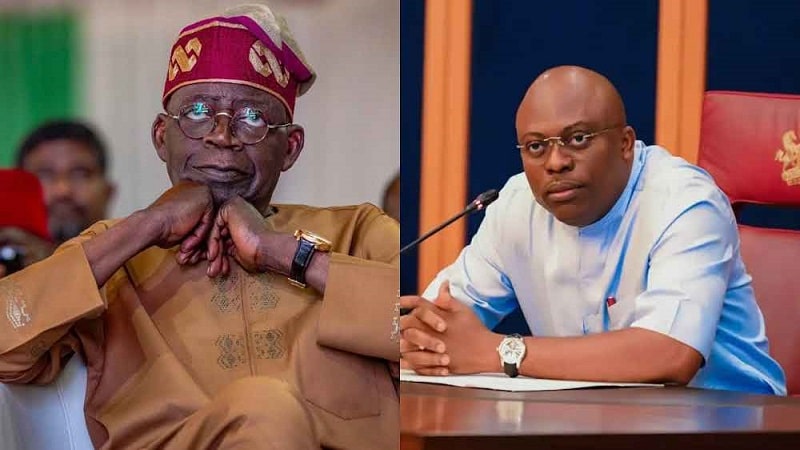

The Nigerian Bar Association (NBA) has doubled down on its stance that President Bola Tinubu’s removal of Rivers State Governor Siminalayi Fubara is illegal and wants him to undo it. On Tuesday, Tinubu declared a state of emergency in Rivers State, suspending Fubara, his deputy, and all state lawmakers due to the ongoing political chaos in the oil-rich state. He then named Ibok-Ete Ibas, a retired naval chief, as the state’s sole administrator.

The NBA, led by President Afam Osigwe, who appeared on Sunday Politics, first slammed Tinubu’s move and now insists Fubara should return as governor. Osigwe said the Constitution doesn’t allow for a “sole administrator” to run a state. “We believe the president must bring Fubara back after removing him illegally,” he told the show. “We don’t see this sole administrator as the rightful leader in Rivers State—his appointment breaks the Constitution. I even wondered what oath he took, since the Constitution doesn’t mention an administrator.”

Osigwe, a Senior Advocate of Nigeria, compared Tinubu’s approach to smashing a headache with a sledgehammer—way too extreme. He called the steps “over the top, undemocratic, and flat-out unconstitutional,” arguing that Rivers’ political mess needs a political fix, not this. Some say Tinubu used a vague part of Section 305 of the 1999 Constitution, but Osigwe shot that down. “It’s not unclear—we’re just choosing to twist it,” he said.

The National Assembly backed Tinubu’s emergency declaration, but Osigwe isn’t buying that it makes it legal. He said their approval is like “building on quicksand”—it doesn’t hold up.