The Central Bank of Nigeria (CBN) has retracted its previous directive that required banks to impose a controversial 0.5% cybersecurity levy on electronic transactions.

This decision follows significant public backlash that emerged after the policy's announcement two weeks ago and the Federal Government's suspension of the levy last week.

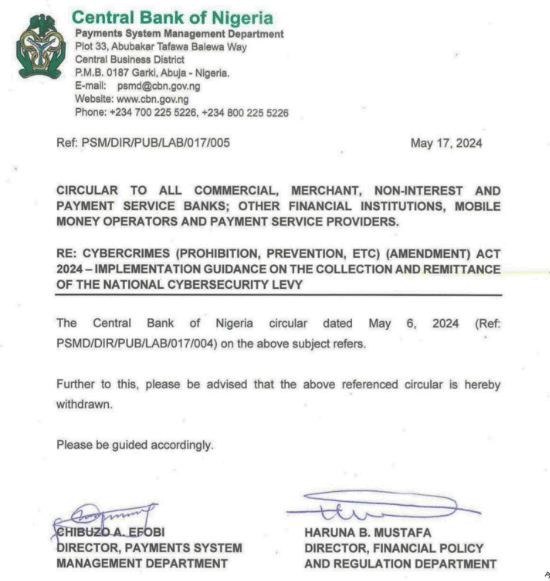

In a new circular dated May 17, 2024, the CBN referenced its earlier directive from May 6, 2024, informing financial institutions that the initial circular on the cybersecurity levy "is hereby withdrawn." This latest circular was signed by Chibuzo Efobi, Director of the Payments System Management Department, and Haruna Mustafa, Director of the Financial Policy and Regulation Department.

The initial circular had been addressed to all deposit money banks, mobile money operators, and payment service providers, instructing them to deduct the levy and remit it to the National Cybersecurity Fund (NCF), managed by the Office of the National Security Adviser (ONSA).

The policy's announcement led to widespread public outrage, with labor unions threatening action and pressure groups criticizing the levy’s timing amid a cost-of-living crisis exacerbated by rising inflation. Responding to the public outcry, the Federal Government suspended the contentious cybersecurity levy on May 14, 2024.