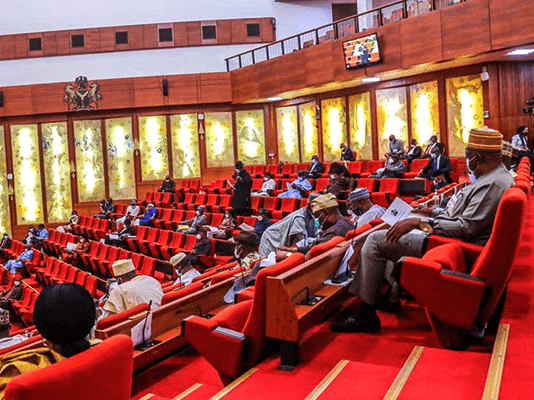

The Senate Committee on Banking, Insurance, and Other Financial Institutions has summoned the Central Bank of Nigeria Governor, Olayemi Cardoso, to appear before the Committee next Tuesday, the 6th of February.

The move comes amid pressing concerns about the state of the economy and the sharp decline of the naira in the foreign exchange market, with the official window reporting that the naira fell to an all-time low of 1,520 naira to a dollar yesterday.

The Senate said it is seeking solutions from the apex bank governor to stabilise the currency and restore economic confidence.

Meanwhile, the CBN said it has fulfilled its pledge to clear the backlog of foreign exchange owed to foreign airlines in the country.

In a statement, CBN said it concluded the payment of all verified claims by airlines with an additional 64.44 million dollars to the concerned airlines.

Earlier, the CBN also said it further released 500 million dollars to various sectors to address the backlog of verified foreign exchange transactions.